20+ Mortgage preapproval

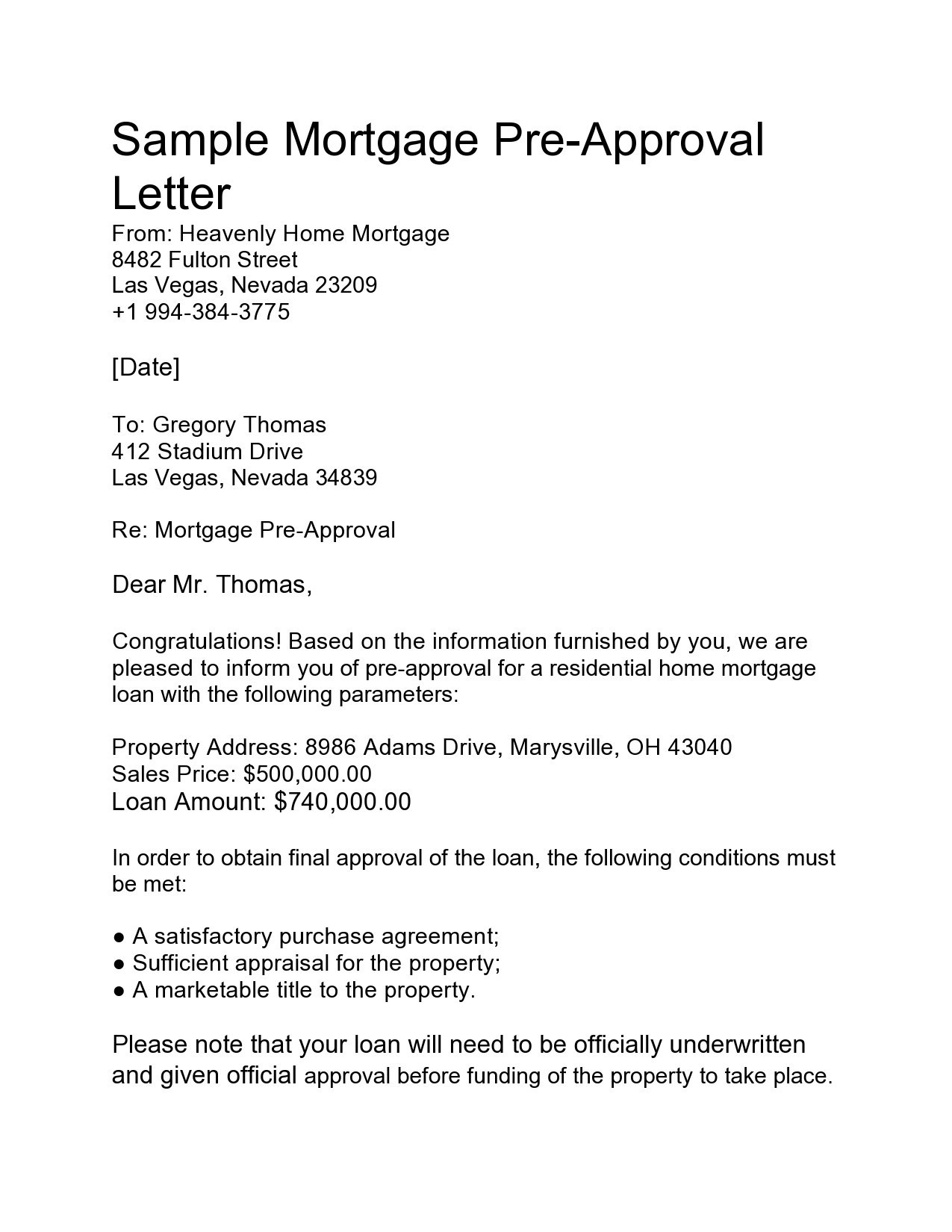

Compare Current Refinance Rates. A mortgage pre-approval approves you for only one number and that is NOT the purchase price.

Mortgage Closing Checklist Everything You Need To Know About Your Closing

The lenders average closing time is.

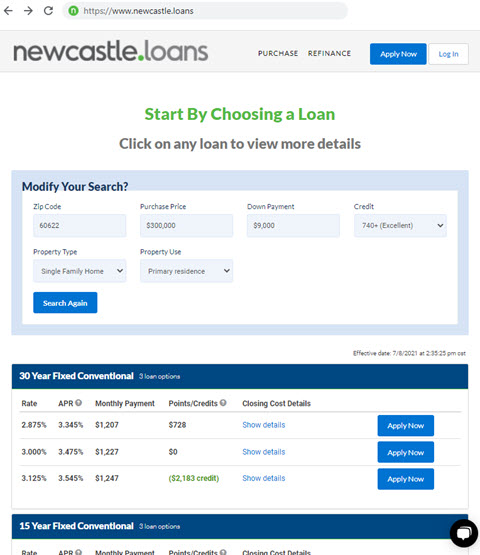

. The most popular mortgage term is 30 years but 15- and 20-year mortgages are also available. A loan pre-approval is not a loan officer doing a quick review of your information and. STEP 1 Answer a few questions Tell us about you and what youre looking for.

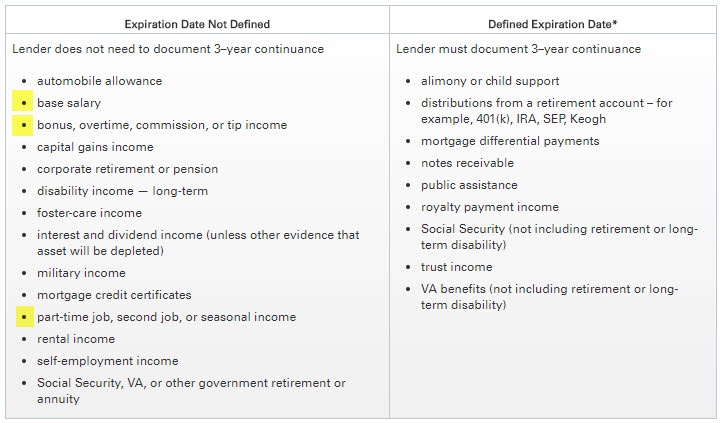

STEP 2 Review lender matches Compare highly-rated lender partners. Heres a list of documents that you need to present to be pre-approved or to secure final loan approval before closing. Lets take a look at some of the common credit score ranges and what they mean for mortgage preapproval.

Mortgage pre-approval is the process of the lender providing you a loan estimate based on your financials. Once your mortgage lender has the required documents to verify your information you can usually expect to hear from your lender within the same day or up to 3 business days. Bank statements 60 days Pay.

Heres how it works. It usually takes four to five days to get pre-approved. Tax returns for the past two years and all schedules if you are self-employed or have rental income.

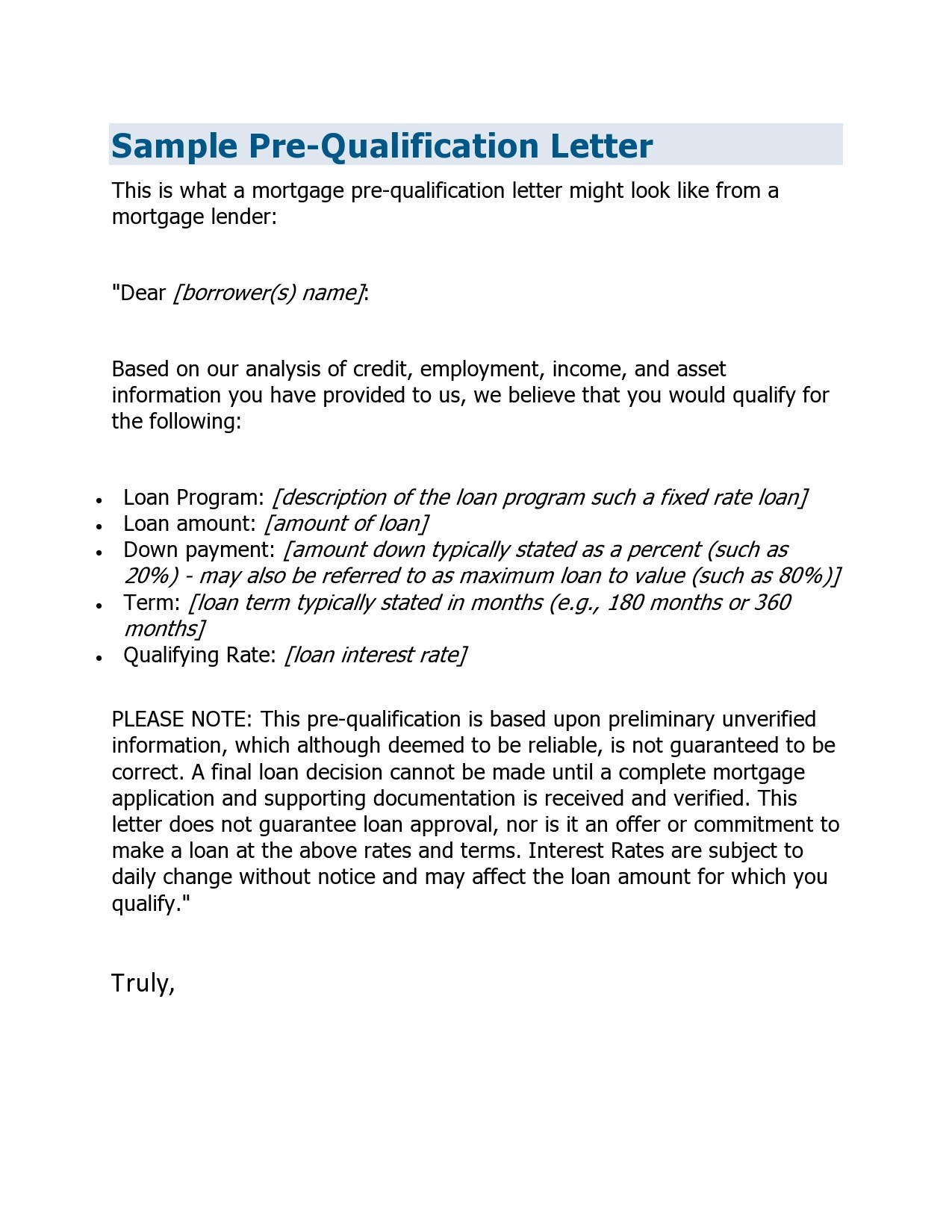

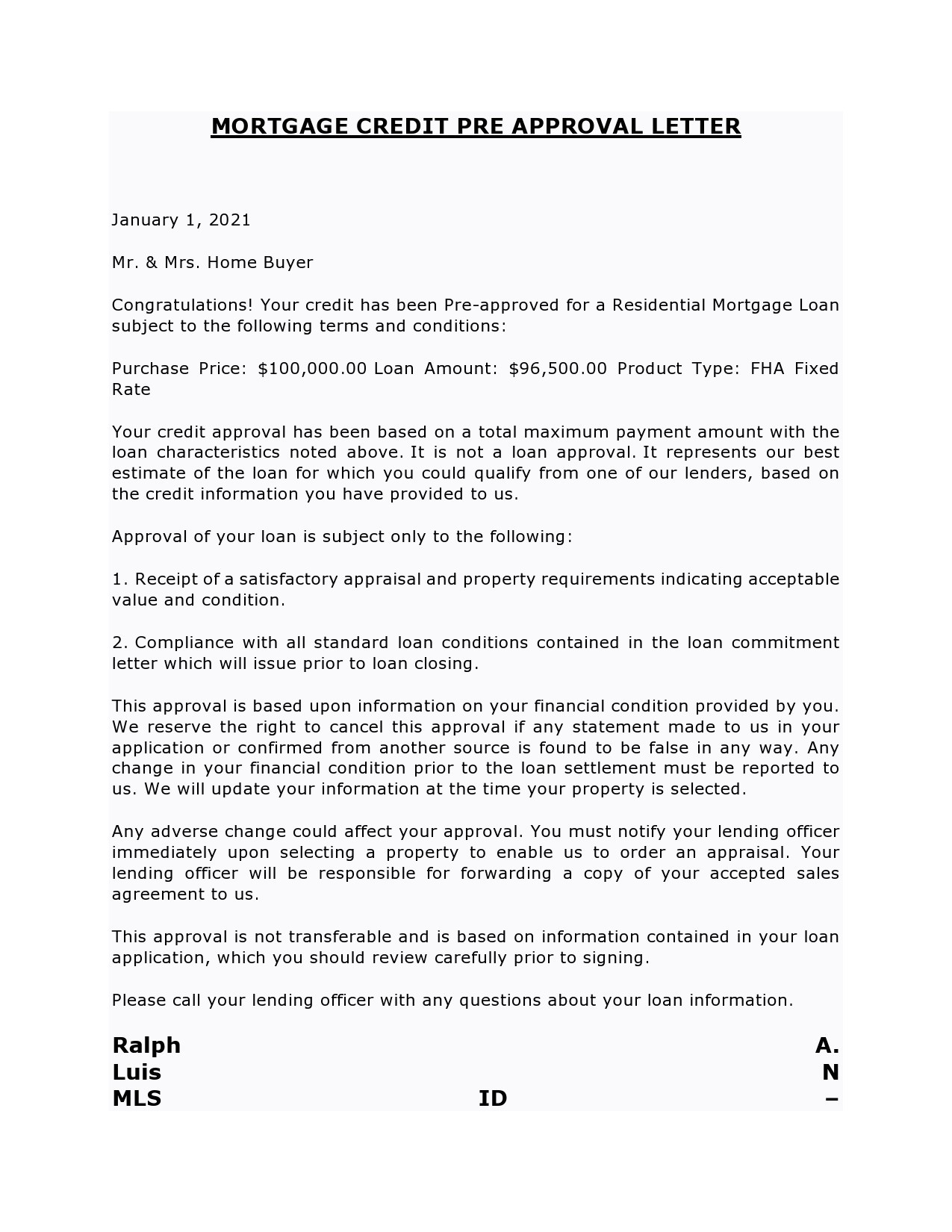

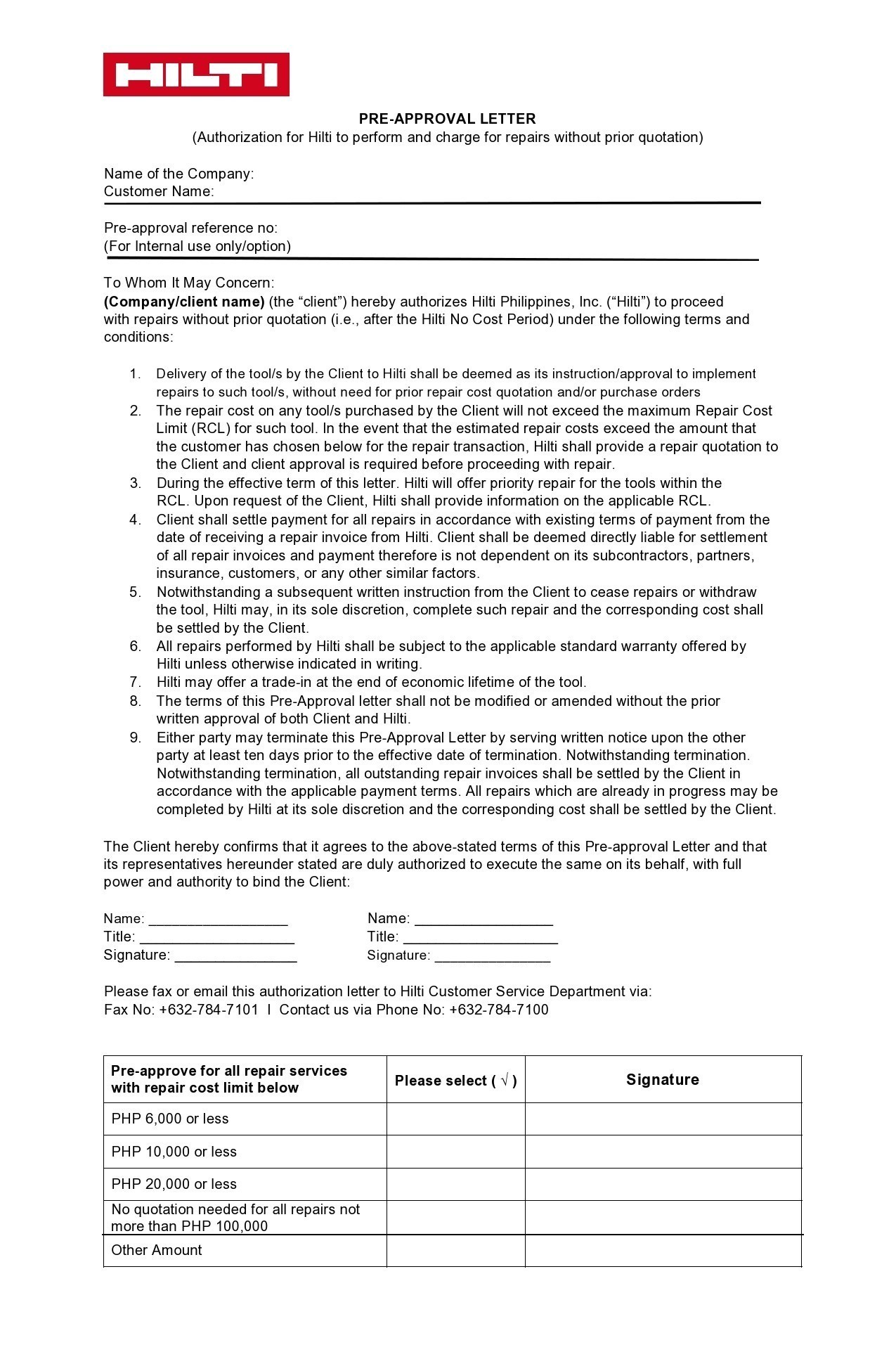

Complete a full mortgage application. You can win mortgage preapproval in as little as 20 minutes with a letter to follow according to a Bank of America spokesperson. A mortgage preapproval is a letter from a mortgage company verifying that you are preapproved for a specific loan amount.

Mortgage payments are spread out monthly through the term. Gather the following documents required for pre-approval and final loan approval. 30 days of pay stubs.

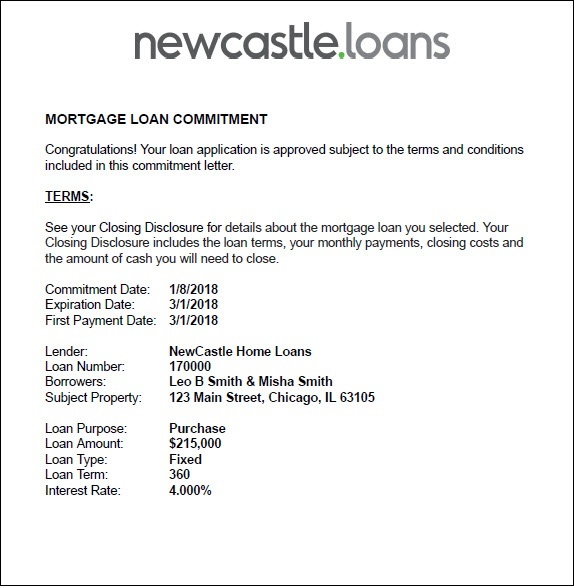

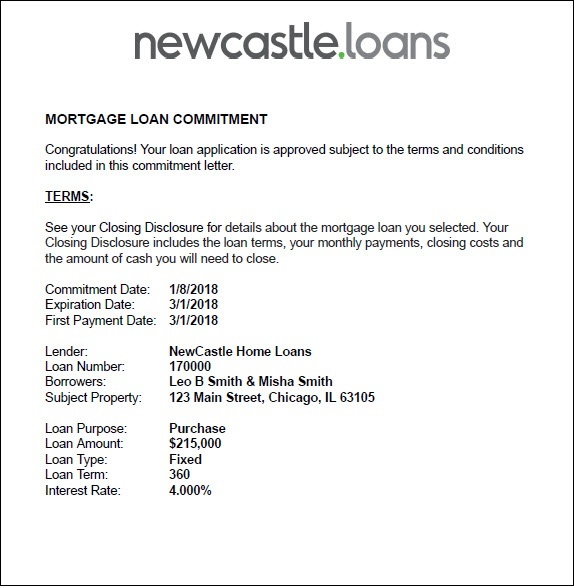

In a mortgage preapproval a lender looks at your credit and finances to determine how big of a mortgage loan it is willing to give you. Once pre-approved youll receive a pre-approval letter that is a conditional commitment from the. The preapproval letter is a 1-page document.

The lender will want a filled out loan. Most of this application process was completed. Being prepared and organized will make the application process easier.

Your identity employment income assets debt. Mortgage statements and homeowners insurance for any property you will continue to. After selecting a lender the next step is to complete a full mortgage loan application.

Calculate your debt-to-income ratio your total monthly debt payments divided by your gross monthly income. Lenders will typically require you. Mortgage pre-approval usually expires between 30 to 90 days depending on the lender.

13 hours agoOn a 20-year mortgage refinance the average rate is 615 and the average rate on a 51 ARM is 453. Prospect Mortgage Preapproval Letter example. 60 days of bank statements.

Collect all the documents youll need for the preapproval. It is a formal process where you have to submit a host of.

Mandatory Mortgage Documents Preapproved Mortgage Mortgage Mortgage Tips

How To Get A Mortgage In 8 Steps

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Understanding Your Mortgage Commitment Letter

40 Real Fake Pre Approval Letters For Mortgage Loan

Central Park Tower Loses Its Spire Will Stand 1 550 Feet Supertall Tower Pearl River Tower

B2b Data Services

List Of Documents For A Mortgage Loan Getting Into Real Estate Real Estate Terms Buying First Home

40 Real Fake Pre Approval Letters For Mortgage Loan

Can I Qualify For A Mortgage If I M Employed Through A Staffing Agency

Here Is A Comprehensive Mortgage Pre Approval Checklist Of The Items You Need To Submit To Your Mortgage Len In 2022 Good Credit Mortgage Approval Preapproved Mortgage

Downloadable Free Mortgage Calculator Tool

40 Real Fake Pre Approval Letters For Mortgage Loan

Mortgages For Condos What You Need To Know Mortgage Mortage Condo

9 Steps To Buying A Home Great Info For First Time Home Buyers Need To Get Pre Approved Let S Chat 949 600 0 First Time Home Buyers Real Estate Home Buying

40 Real Fake Pre Approval Letters For Mortgage Loan

How To Get A Daca Mortgage Loan